What is bookkeeping?

At Clear Books, we aim to make accounting as simple as possible — so you can spend less time worrying about keeping track of your accounts and more time growing your business. With this in mind, we’ve created a handy guide to the basics of bookkeeping, which will help you get started — or refresh your memory.

The beginning:

DEBITS AND CREDITS

Most businesses will use a system known as ‘double entry bookkeeping’ to manage their finances.

This means that every transaction will be entered into your accounting records twice — once as a debit [Dr] entry and once as an equal and opposite credit [Cr] entry.

Double-entry bookkeeping is preferable to single entry bookkeeping (where there is no corresponding opposite transaction) as, by entering it twice, there is less chance of making mistakes.

The easiest example to demonstrate this is by thinking of a shop making a cash sale, it ‘debits’ its cash record, reflecting the increase in the money in the till, and ‘credits’ the sale record to reflect the fact that an extra sale has been made.

The overall rule of thumb that covers the majority of entries in the books is that:

Debits will increase assets or expenses

Credits will increase income or liabilities

Examples of debits

Assets

- Cars

- Computers

- Stock

- Cash

- Money owed to you by customers

Expenses

- Travel

- Materials

- Salaries

- Bank charges

An asset is something that you own or an amount that someone (a debtor) owes you, and an expense is a cost needed to run your business.

Examples of credits

Liabilities

- Bank overdraft

- Money you owe a supplier

- Loan from a bank

- Loan from a person

Income

- Sales of goods

- Fees charged for services

- Rental income

- Interest earned

A liability is something that you owe to somebody (a creditor) and income is earnings from running your business.

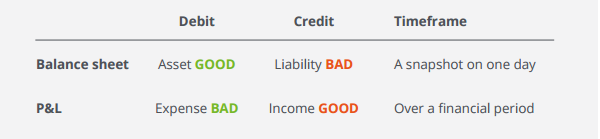

But how do you manage and think about debits and credits, if seemingly good things are bad and bad things are good?

The overall rule of thumb that covers the majority of entries in the books is that:

Asset (debit) GOOD Liability (credit) BAD

Expense (debit) BAD Income (credit) GOOD

Short term or long term?

In addition, to make it easier to manage, we define assets as being:

- Fixed (>1 year) e.g. cars, computers and buildings or;

- Current (<1year), e.g. stock, money, amounts owed by customers.

Examples of debits

In other words, a Fixed Asset is something that we are going to hold on to for a few years whereas a Current Asset is something that that changes on a regular basis.

Liabilities too can be short or long term:

- Long term (>1year) e.g. a 5 year bank loan

- Short term (< year) e.g. money you owe to suppliers or a bank overdraft.

Accounts

It is worth mentioning that when we talk about the individual accounting ‘records’ above, such as Sales, Bank, Cars, Loans, Travel, Salaries, Sums owed to suppliers etc., we are talking about ‘accounts’, e.g. the Sales account, Bank account, Travel account etc. If it’s easier, think of them as categories under which transactions are recorded.

Accruals

Accruals concept of accounting

When recording entries in the books, another useful term to be aware of is the accruals concept of accounting, which means that all entries are recognised in the period in which they accrue (arise/happen) rather than when they are paid.

Recording entries purely from sums in and out of a bank account is known as cash accounting, but this is only allowed for tax purposes in the smallest of self employed businesses.

The simplest example of accruals accounting is where you record a sale in the books when you send an invoice to the customer, rather than when that customer pays it, which may not take place for weeks or months.

The double entry for this entry therefore is to debit the unpaid invoices account, thus increasing what customers you, and crediting the sales account.

There are several additional accounting adjustments which may be needed to ensure that you are following the accruals concept in all respects. These are as follows:

Accrued expenses: Accruals:

This would occur when you do not receive a bill from a supplier but you know that you have incurred the cost. For example, accountancy fees when an accountant bills you next month for work done this month, or an electricity bill for this quarter’s charges that doesn’t arrive, and is dated, next month.

Prepaid expenses: Prepayments:

This occurs when you receive the supplier bill today but it relates to goods or services that you will not receive until a later date or period. For example getting billed for insurance or subscriptions a year in advance.

Accrued income

This occurs when you have sent out goods or carried out work for someone but you have yet to send them a sales invoice. This would occur in the books of the accountant above where their income has accrued (arisen/happened) this month but they don’t send an invoice till next month.

Deferred income

This occurs when you have invoiced someone in advance of goods going out or work being done. Again, this is the other side to the examples of prepayments above, where the insurance company or supplier invoices today for a service that will span a year ahead.

In all of the above cases manual adjustments have to be made to the basic bookkeeping to make sure that recorded income or expenses are actually reflected in the correct period.

So adjustments for accrued expenses and income bring entries back into an earlier period and adjustments for prepaid expenses and deferred income carry entries forward into a later period.

Balance Sheet and Profit & Loss

At the end of the year the totals in all of the individual ‘accounts’ are listed to produce the financial statements (year end accounts). These financial statements comprise:

- Balance Sheet (Asset and Liability accounts)

- Profit & Loss (Income and Expense accounts)

Think of these two statements as follows:

Balance Sheet

The Balance Sheet is a snapshot of a company’s assets and liabilities on the last day of the year and, because of the double entry, the difference between these two will represent the accumulated profits or losses that have occurred since the business started.

Profit & Loss

The Profit & Loss account is a summary of the financial performance of the company in the financial year, comparing its income with its expenses with the difference between the two being either the profit or loss for the year. As mentioned, it’s not just money in and out.

Trial Balance

You may also hear mention of a Trial Balance which is just one report that incorporates all the Profit & Loss and Balance sheet accounts above, with the numbers listed as debits or credits and, hopefully, with the total of the debit accounts equalling the total of the credit accounts.

That’s it!

These are the very basics that you need to know to help manage and understand your finances. We hope this has provided you with some helpful tips to get started with bookkeeping.

We also have lots of further resources that can help you to get your head around it!

- Glossary of accounting terms

- Monthly bookkeeping workshops

- Double entry bookkeeping support guide

- Contact our support team on support@clearbooks.co.uk or call 020 3475 4744 (Monday to Friday 9am-5pm)